The global landscape is constantly evolving, and its impact on Chinese markets is profound and multifaceted. By examining five potential scenarios that could shape the trajectory of the Chinese markets in 2025 and 2026, we gain insight into the complexities and uncertainties that lie ahead.

Scenario 1: Global Trade Tensions Ease

One possibility is that global trade tensions between major economies, such as the US and China, see a significant reduction. This scenario could lead to increased market stability and improved investor confidence in Chinese markets. Companies may benefit from more predictable trade policies and smoother access to international markets, fostering growth and innovation in key industries.

Scenario 2: Technological Innovation Boom

Another potential scenario is a technological innovation boom that propels Chinese companies to the forefront of cutting-edge industries such as artificial intelligence, biotechnology, and renewable energy. This could result in China becoming a global leader in innovation, attracting significant investment and enhancing its competitiveness on the international stage.

Scenario 3: Environmental Regulations Tighten

Amid growing global concerns about climate change and environmental sustainability, stricter regulations may be imposed on Chinese companies to reduce carbon emissions and adopt more sustainable practices. While this could pose challenges for some industries, it could also create new opportunities for firms specializing in green technologies and eco-friendly solutions.

Scenario 4: Geopolitical Shifts Impact Markets

Geopolitical developments, such as changes in international alliances or conflicts, could have far-reaching implications for Chinese markets. Shifts in geopolitical dynamics may disrupt supply chains, alter trade relationships, or create new investment opportunities, requiring companies to stay agile and adaptable in navigating geopolitical uncertainties.

Scenario 5: Economic Slowdown

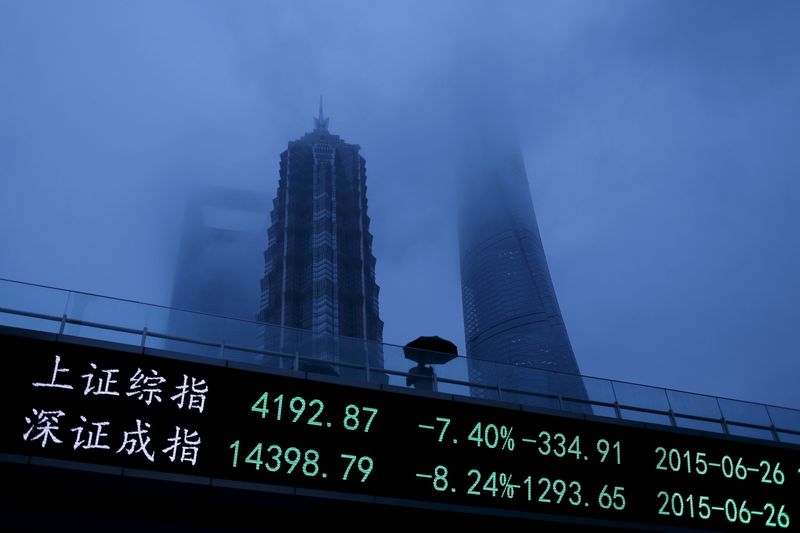

Finally, a scenario of global economic slowdown or recession could have significant repercussions for Chinese markets. Reduced consumer demand, market volatility, and financial instability may pose challenges for businesses operating in China, necessitating strategic planning and risk management to weather economic downturns and emerge resilient.

In conclusion, the future of Chinese markets in 2025 and 2026 is shaped by a complex interplay of global scenarios that can influence market dynamics, investment trends, and business strategies. By anticipating and analyzing these potential scenarios, companies can better prepare for uncertainties, capitalize on opportunities, and navigate the evolving landscape of the global economy.