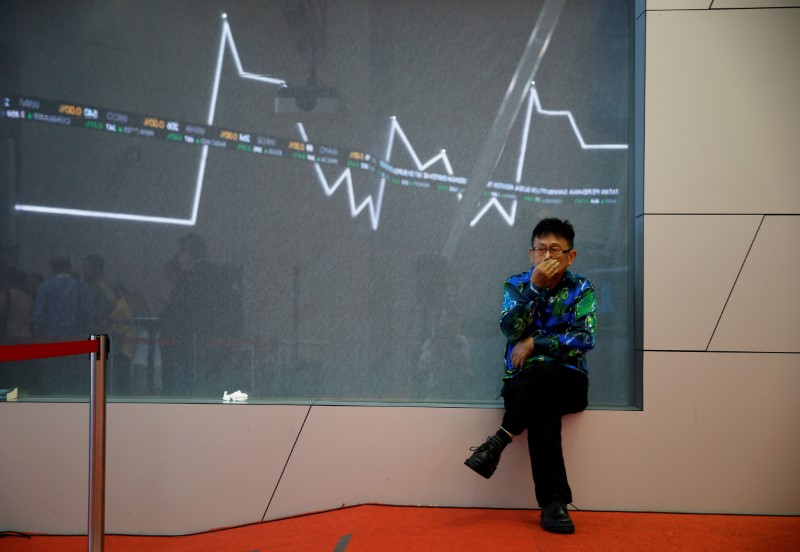

In the world of global finance and investment, monitoring stock markets is a crucial task for investors, analysts, and policymakers alike. The Indonesia Stock Exchange (IDX), also known as the Bursa Efek Indonesia (BEI), serves as a vital platform for trading various securities in Indonesia. Recent market data indicates that the IDX Composite Index experienced a decline of 0.33% at the close of trading, reflecting the dynamic nature of stock markets and the ever-changing economic landscape.

One key aspect to consider when analyzing stock market movements is the underlying factors that may influence investor sentiment and trading behavior. Economic indicators, geopolitical events, corporate earnings, and market rumors all play a role in shaping the direction of stock prices. In the case of the IDX Composite Index, the 0.33% decrease could be attributed to a variety of factors, such as profit-taking by investors, concerns about economic growth, or external market conditions.

It is also important to recognize that stock market fluctuations are not always negative. While a decline in the index value may raise concerns among investors, it can also present new opportunities for strategic investments. For savvy investors, market dips can be a chance to buy stocks at a discounted price, thus potentially reaping profits when the market recovers.

Furthermore, the IDX Composite Index is just one of many indices that provide insights into the performance of stock markets. Investors should consider diversifying their portfolios across different asset classes and geographical regions to mitigate risks and maximize returns. By staying informed about market trends, conducting thorough research, and seeking professional advice, investors can navigate the complexities of stock market investing with more confidence.

In conclusion, the recent 0.33% decline in the IDX Composite Index serves as a reminder of the dynamic nature of stock markets and the importance of staying informed and adaptive in the face of fluctuations. While market volatility can be unsettling, it also presents opportunities for strategic investments and long-term growth. By remaining vigilant, proactive, and informed, investors can navigate the ever-changing landscape of stock market investing with greater clarity and confidence.