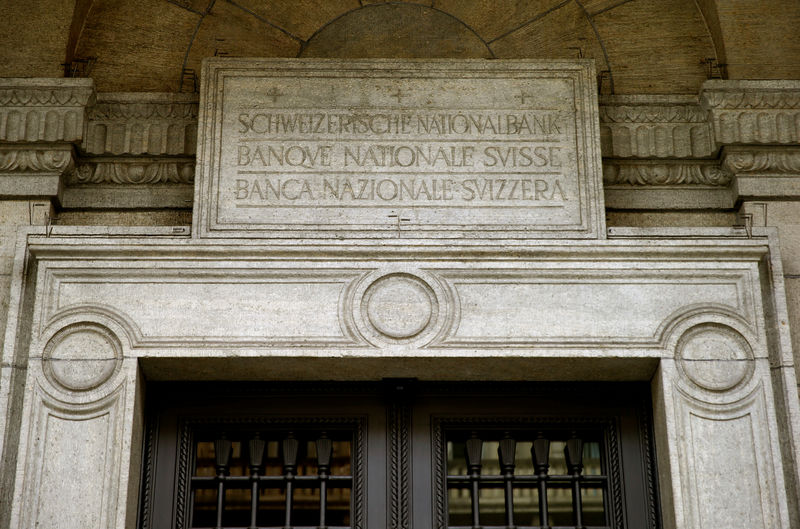

The recent decision by the State National Bank (SNB) to once again cut interest rates marks the third consecutive reduction in a bid to stimulate the economy amidst challenging global economic conditions. This move comes as part of the central bank’s efforts to address the growing concerns over economic growth and inflation. However, while the decision is aimed at boosting economic activity, it has also raised debates and concerns among experts and market participants.

One of the key implications of the interest rate cut is its impact on the borrowing costs for businesses and consumers. Lower interest rates make borrowing more attractive, leading to increased investments and spending, which in turn can spur economic growth. This can be particularly beneficial for businesses looking to expand operations or individuals seeking to make large purchases such as homes or cars.

Additionally, lower interest rates can also have repercussions on the housing market. Cheaper borrowing costs could potentially drive up demand for housing, leading to higher prices in the real estate market. This could be a boon for homeowners looking to sell their properties but may pose challenges for first-time buyers or those looking to enter the market.

Moreover, the decision to slash interest rates can have far-reaching impacts on various sectors of the economy, including exports and imports. A weaker currency resulting from lower interest rates can make exports more competitive in the global market, boosting demand for domestically produced goods and services. On the flip side, it could also lead to higher prices for imported goods, affecting consumers and potentially contributing to inflationary pressures.

However, while the interest rate cut may have its advantages, it also comes with its own set of risks and uncertainties. Critics of the move argue that prolonged low interest rates could lead to asset bubbles, as investors may seek higher returns in riskier assets due to low returns in traditional investments. This could potentially destabilize financial markets and pose risks to the overall economy.

Furthermore, the impact of interest rate cuts on savers and retirees cannot be overlooked. Lower interest rates mean lower returns on savings accounts and fixed-income investments, affecting those who rely on these assets for income. This can pose challenges for individuals planning for retirement or relying on interest income to meet their financial needs.

In conclusion, the State National Bank’s decision to cut interest rates for the third consecutive time underscores its commitment to supporting economic growth amidst challenging global economic conditions. While the move is expected to have positive impacts on borrowing costs, investments, and overall economic activity, it also raises concerns regarding potential inflationary pressures, asset bubbles, and impacts on savers and retirees. As the economy navigates through these uncertain times, it will be essential for policymakers to carefully monitor the effects of the interest rate cuts and implement measures to ensure a balanced and sustainable economic growth trajectory.